本文是托谱网课代上原创essay代写案例,叙述了一位没有孩子的单身女士,她不需要为父母的生活负担。 她每月的总收入为17,300美元,总成本为5900美元。 投资收入是她收入的最大部分。 此外,她的工资是每月4000美元。 因此,每月剩余11,400美元,这样一篇关于个人财务管理的故事。

Personal Details of Client

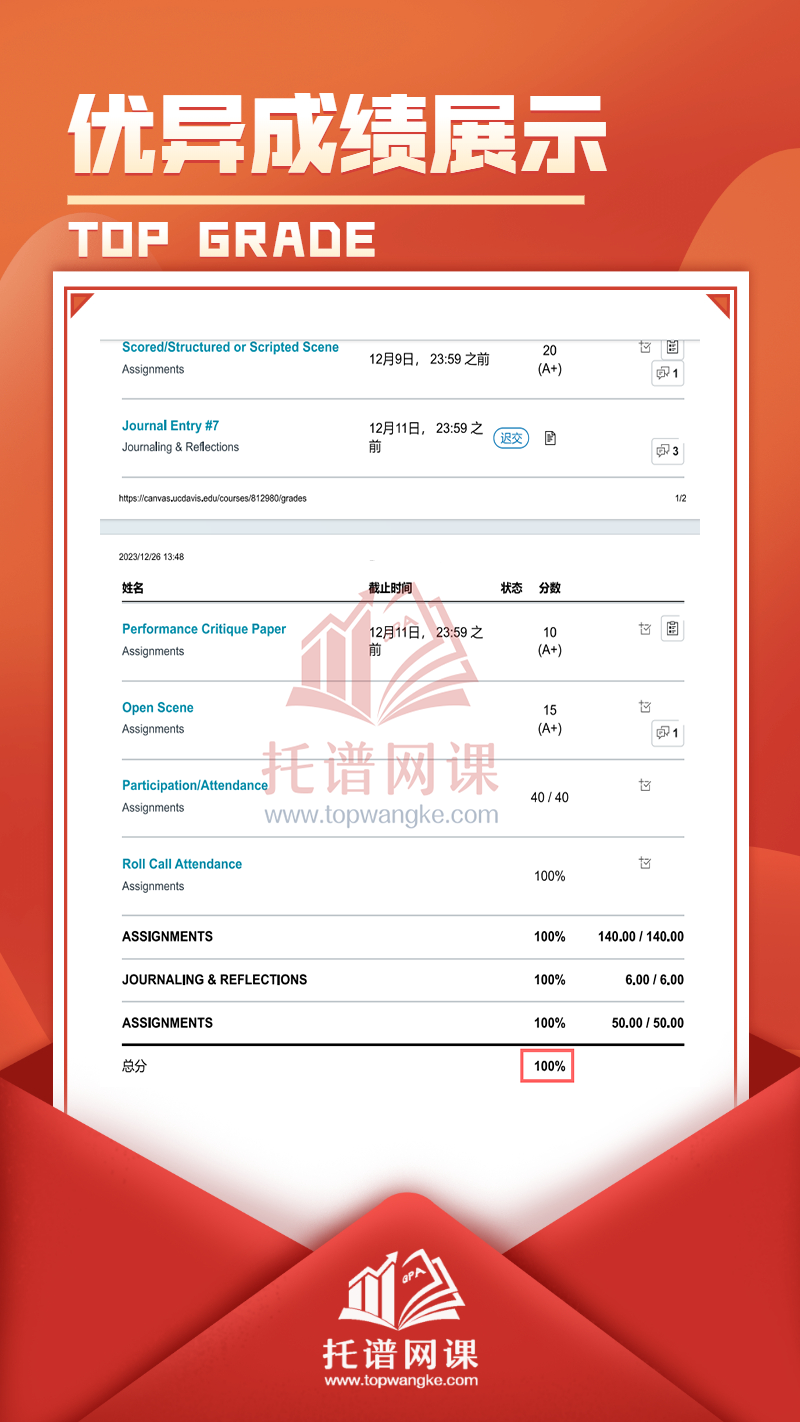

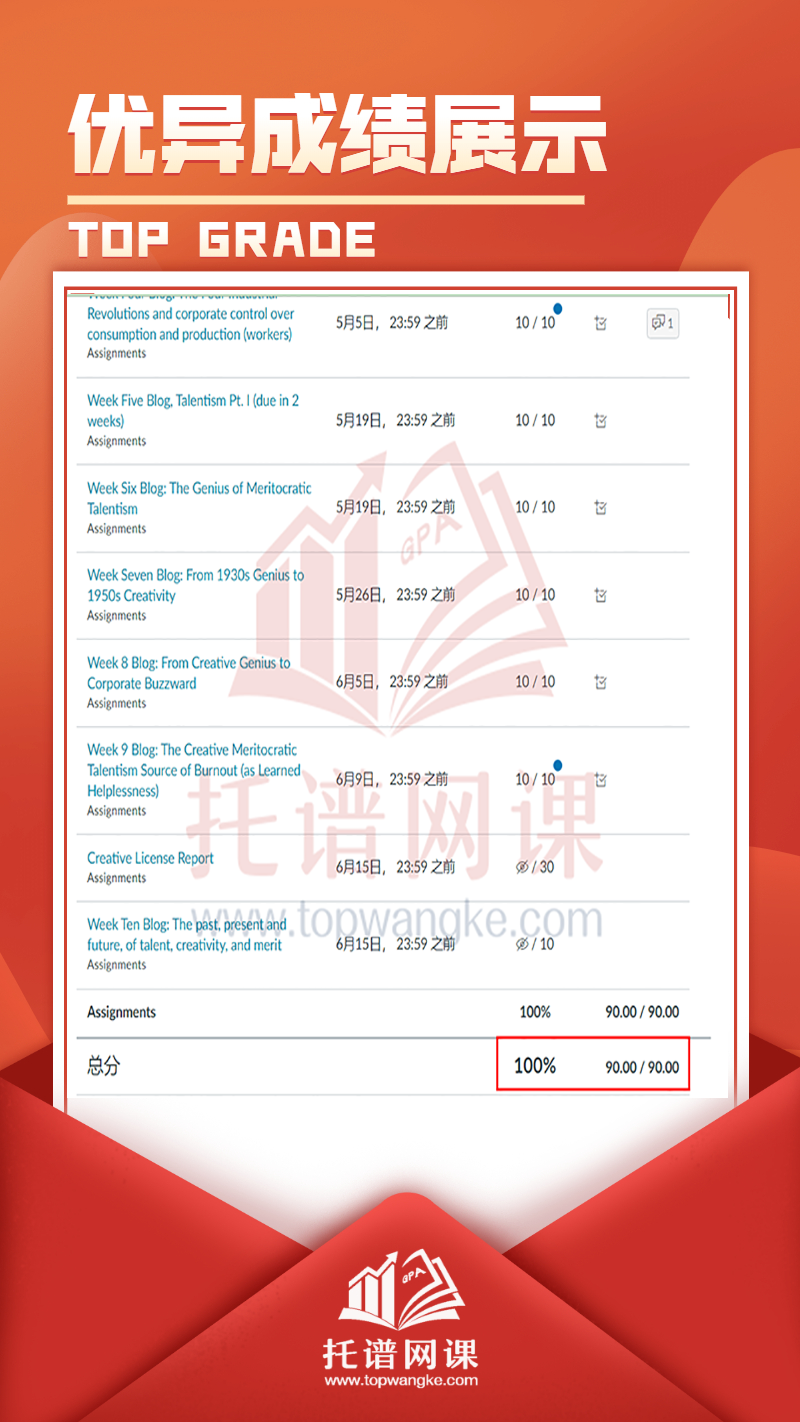

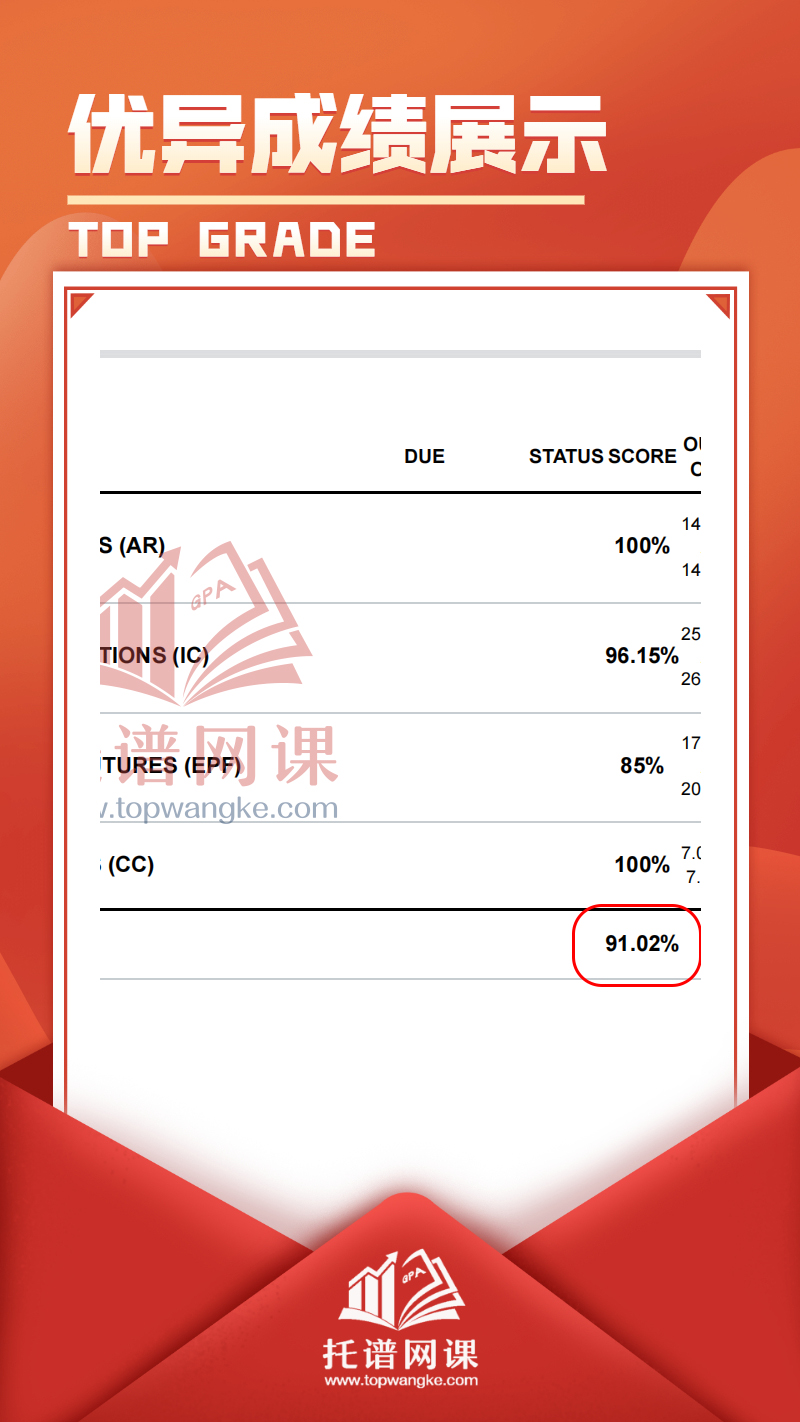

The client is a single lady with no children. Besides, she doesn’t need to afford the cost for her parent’s living. Her total revenue per month is 17,300 dollars with 5900 dollars as total cost. The investment income is the biggest part of her income. In addition, her salary is 4,000 dollars per month. Thus, there are 11,400 dollars left per month.

Objectives

The goal of this client is to make full use of the rest of money, the asset that she already has and prepares herself for the risk that she might come within the future.

Recommendations

The first recommendation aims to help her on the salary. She gets 4,000 dollars per month for her salary, that’s 48,000 dollars per year. Thus, her tax payable equals 7147 dollars. She could minimize her tax through several ways, such as getting more annual bonus instead of salary and increasing the base of contributions for insurance and provident funds.

The second recommendation is about the allocation of her main asset. The asset she already owned includes cash, stock shares, real estates like cars and house. It is important to understand that different asset class differs in the risk and expected returns. For example, although stock shares have very high potential returns, the risk and the possibility of loss is also extremely high. Thus, the recommended allocation of the asset is to allocate 10% for daily consumption such as clothing, food, and education, 20% for emergency insurance like the car accident and serious illness, 30% of the total asset for equity earning like fixed interest, share trust which has both high returns and high risk, 40% of the total asset can be allocated to long-term income, like the bond and pension.

The next recommendation concerns about managed funds. It is a way to manage people’s wealth (Sawicki& Julia,2000). I recommend to choose an emerging wealth management method, that is P2P wealth management platform, which is becoming more and more popular with the fast development of the Internet (Zhao, Hongke, et al, 2016) The advantage of P2P platform is that it is safe and reliable with stable profit rate. Besides, it is also easy to operate.

The third recommendation relates to some insurance and superannuation, which could help us to defend potential risks in the future life. The most two important insurances are private health insurance and life insurance(Amelie C,2016). When choosing these two type of insurance, it is necessary to pay attention to the method of compensation, the hospital cover, the term of the grace period as well as your own financial state into consideration.

Expected Outcomes

As for the expected outcome, the client would save a certain amount of money on tax. Besides, the allocation of her current asset would make sure that she would get more extra returns under her own risk preference. The insurance and superannuation could protect her from potential risk and secure her life after retirement.

References:

Sawicki, Julia, and F. Ong. "Evaluating managed fund performance using conditional measures: Australian evidence." Pacific-Basin Finance Journal 8.3(2000):505-528.

Zhao, Hongke, et al. "Portfolio Selections in P2P Lending:A Multi-Objective Perspective." ACM SIGKDD International Conference on Knowledge Discovery and Data Mining ACM, 2016:2075-2084.

Wuppermann, Amelie C. "Private Information in Life Insurance, Annuity and Health Insurance Markets." Scandinavian Journal of Economics 119.4(2016).